Offshore Company in Hong Kong

International Finance Center

Simple tax system

We will only notify the newest and revelant news to you.

Whether you are doing business in Europe, Asia, Africa, the Middle East, the Americas or elsewhere, Offshore Company Corp will set up the best trading or holding structure for your business in line with local laws and regulations.

International Finance Center

Simple tax system

Financial center in Southeast Asia

Free income tax for the Holding company

Leading maritime business activities

No minimum capital required

Stable political and economical system

Corporate income tax exemption

Economic center in Asia

Friendly and transparent business environment

Infrastructure highly develop

Tax exemption and non-financial reporting required

Member of many commercial institutions

The most dynamic emerging economy

Low corporate tax rates

Business infrastructure developed

Tax exemption for foreign companies

Excellent communication system and infrastructure

Open economy policies

Gateway to EU/EEA and Switzerland markets

Highest labor productivity in the world

2st in the world about global logistics capabilities

A modern legal system

Transportation and logistics hub

Concentration of large financial institutions

Comprehensive protection policy

Liberal tax system

Head office of multinational firms

Gateway to access Europe markets

Global financial service center

Stable political system

Flexible corporate management structure

Leading banking sectors

No corporation tax for offshore corporate

Tax-exempted on profits and capital gains

Highly confidential information

International financial center

High-level information security

One of the international business center

The fastest-growing economy in Central America

Tax-free, no exchange control

A wide network of international banks

Starting small and reaping big rewards

Increasing income and gaining wealth

Exemption from income tax on profits

Leading position for foreign investment

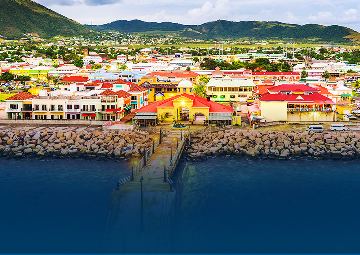

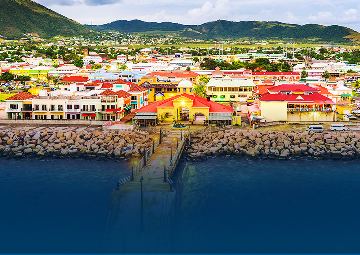

The economy prospered in the Caribbean

Perfect place for managing yachts and ships

One of the world’s largest logistics hubs

Leading host for global foreign investment

One of the fastest-growing economy

Free and open business environment

Variety incentive tax policies

Secured asset protection

Asset protection from a foreign corporation.

Better banking infrastructure.

See more jurisdiction we offer in the Asia Pacific and choose your favorite jurisdiction

International Finance Center

Simple tax system

Financial center in Southeast Asia

Free income tax for the Holding company

Leading maritime business activities

No minimum capital required

Stable political and economical system

Corporate income tax exemption

Economic center in Asia

Friendly and transparent business environment

Infrastructure highly develop

Tax exemption and non-financial reporting required

Member of many commercial institutions

The most dynamic emerging economy

See more jurisdiction we offer in the Europe and choose your favorite jurisdiction

Low corporate tax rates

Business infrastructure developed

Tax exemption for foreign companies

Excellent communication system and infrastructure

Open economy policies

Gateway to EU/EEA and Switzerland markets

Highest labor productivity in the world

2st in the world about global logistics capabilities

A modern legal system

Transportation and logistics hub

Concentration of large financial institutions

Comprehensive protection policy

Liberal tax system

Head office of multinational firms

Gateway to access Europe markets

Global financial service center

See more jurisdiction we offer in the Caribbean and choose your favorite jurisdiction

Stable political system

Flexible corporate management structure

Leading banking sectors

No corporation tax for offshore corporate

Tax-exempted on profits and capital gains

Highly confidential information

International financial center

High-level information security

One of the international business center

The fastest-growing economy in Central America

Tax-free, no exchange control

A wide network of international banks

Starting small and reaping big rewards

Increasing income and gaining wealth

Exemption from income tax on profits

Leading position for foreign investment

The economy prospered in the Caribbean

Perfect place for managing yachts and ships

See more jurisdiction we offer in the Middle East and choose your favorite jurisdiction

One of the world’s largest logistics hubs

Leading host for global foreign investment

See more jurisdiction we offer in the Africa and choose your favorite jurisdiction

One of the fastest-growing economy

Free and open business environment

Variety incentive tax policies

Secured asset protection

See more jurisdiction we offer in the America and choose your favorite jurisdiction

Asset protection from a foreign corporation.

Better banking infrastructure.

From

US$ 519

A Limited Liability Company (LLC) is a type of business structure that combines features of both a corporation and a partnership (or sole proprietorship, in the case of a single-member LLC). Here's how an LLC works:

It's important to note that while LLCs provide many benefits, the specific rules and regulations governing them can vary from state to state. Therefore, it's essential to understand your state's requirements and consult with legal and financial professionals when forming and operating an LLC to ensure compliance with all applicable laws and regulations.

Whether you need a foreign LLC for your online business depends on several factors, including the nature of your business, where you live, and where your customers are located. Here are some considerations to help you determine if you need a foreign LLC for your online business:

Société anonyme (S.A.) is a French term that refers to a public limited company (PLC), and similar business structures exist worldwide. An S.A. is analogous to a corporation in the United States, a public limited company in the United Kingdom, or an Aktiengesellschaft (AG) in Germany.

An S.A. is subject to distinct tax regulations when compared to sole proprietorships or partnerships, and, in the case of a public S.A., it entails different accounting and auditing obligations. Furthermore, for an S.A. to be considered valid, it must fulfill specific criteria. While these criteria may vary depending on the country, most S.A.s are required to submit articles of incorporation, establish a board of directors, appoint either a managing director or a management board, institute a supervisory board, designate a statutory auditor and deputy, choose a unique name, and maintain a minimum capital amount. Typically, it is formed for a maximum duration of 99 years.

The société anonyme is a widely adopted business structure with equivalents in various languages and countries. Regardless of the specific context, an entity designated as an S.A. provides protection for the personal assets of its owners against creditor claims, thereby incentivizing many individuals to embark on entrepreneurial ventures, as it mitigates their financial risk. Additionally, the S.A. framework facilitates meeting the capital requirements of a growing business, as it allows numerous investors to contribute varying amounts of capital as shareholders, particularly if the company opts for public ownership. Consequently, the S.A. plays a pivotal role in supporting a robust capitalist economy.

![]() 2 mins video Offshore Company has total exemption/low tax. In most jurisdictions/countries, no filing of accounts or submitting of annual returns is required after the offshore company has been incorporated. You can set up an offshore company in many jurisdictions, in many regions around the world, with no restriction based on your nationality, Many banks all over the world allow you to open a bank account for your offshore company and then do business internationally. The laws of almost all jurisdictions/countries we offer protect the confidentiality of the shareholders, directors and offshore company.

2 mins video Offshore Company has total exemption/low tax. In most jurisdictions/countries, no filing of accounts or submitting of annual returns is required after the offshore company has been incorporated. You can set up an offshore company in many jurisdictions, in many regions around the world, with no restriction based on your nationality, Many banks all over the world allow you to open a bank account for your offshore company and then do business internationally. The laws of almost all jurisdictions/countries we offer protect the confidentiality of the shareholders, directors and offshore company.

![]() Initially, our relationship managers will ask you to provide detailed information for all shareholders and directors, including their names. You can select the level of services you need. This stage normally takes one to three working days, or a working day in urgent cases. Furthermore, give the proposed company names so that we can check the eligibility of the names in each jurisdiction’s/country’s company registry/company house.

Initially, our relationship managers will ask you to provide detailed information for all shareholders and directors, including their names. You can select the level of services you need. This stage normally takes one to three working days, or a working day in urgent cases. Furthermore, give the proposed company names so that we can check the eligibility of the names in each jurisdiction’s/country’s company registry/company house.

![]() You settle the payment of our service fee and the official Government fee required for your selected jurisdiction/country. We accept payment by credit/debit card

You settle the payment of our service fee and the official Government fee required for your selected jurisdiction/country. We accept payment by credit/debit card ![]()

![]()

![]()

![]() , Paypal

, Paypal ![]() or by wire transfer to our HSBC bank account.

or by wire transfer to our HSBC bank account. ![]() (Payment Guidelines).

(Payment Guidelines).

See more: Company registration fees

![]() After collecting full information from you, Offshore Company Corp will send you digital versions of your corporate documents (certificate of incorporation, register of shareholders/directors, share certificate, memorandum and articles of association etc) via email. The full Offshore Company kit will be couriered to your residential address by express delivery (TNT, DHL or UPS etc).

After collecting full information from you, Offshore Company Corp will send you digital versions of your corporate documents (certificate of incorporation, register of shareholders/directors, share certificate, memorandum and articles of association etc) via email. The full Offshore Company kit will be couriered to your residential address by express delivery (TNT, DHL or UPS etc).

You can open an offshore bank account for your company in Europe, Hong Kong, Singapore or any other jurisdictions where we support offshore bank accounts! You have the freedom to make international money transfers from your offshore account.

Once your offshore company formation is completed. You are ready to do international business!

No, a certificate of incorporation expires does not terminate. It may be a changeless archive that means the arrangement and legitimate presence of a company from the date it is issued. Once a company is consolidated and the certificate of incorporation expires is issued by the pertinent government specialist, the company proceeds to exist uncertainly until it is formally broken down or struck off the enroll by the administrative body.

A virtual address can be a decent choice for organizations, contingent upon their particular necessities and conditions. Here are a few benefits and contemplations:

A virtual address is especially helpful for:

On the off chance that your business can be categorized as one of these classes, a virtual address can be a decent arrangement. Be that as it may, assuming that your business requires successive in-person client gatherings or you want to follow explicit legitimate necessities, you might have to painstakingly assess whether a virtual location addresses every one of your issues.

In general, if your financial affairs are quite simple, then you may well be able to cope on your own. In the above situations, though, using a tax accountant may be a sound investment.

Yes, in some jurisdictions, virtual offices can be used as registered agents, but there are specific considerations to bear in mind and areas of the law related to this:

You should confirm specific requirements in your state and consult with a legal professional about using a virtual office as your registered agent.

October of 2022 has become a successful month for Offshore Company Corporation (OCC) as we have partnered with SAP - world’s leading business management software producer - to streamline operations and improve our services.

In order to thank you for the long ride we've had over the past time, One IBC would like to bring you an exclusive OCTOBER SALE - Seasonal packages for those who wish to open an offshore company in Seychelles.

There are four rank levels of ONE IBC membership. Advance through three elite ranks when you meet qualifying criteria. Enjoy elevated rewards and experiences throughout your journey. Explore the benefits for all levels. Earn and redeem credit points for our services.

Earning points

Earn Credit Points on qualifying purchasing of services. You’ll earn credit Points for every eligible U.S. dollar spent.

Using points

Spend credit points directly for your invoice. 100 credit points = 1 USD.

Referral Program

Partnership Program

We cover the market with an ever-growing network of business and professional partners that we actively support in terms of professional support, sales, and marketing.

We are always proud of being an experienced Financial and Corporate Services provider in the international market. We provide the best and most competitive value to you as valued customers to transform your goals into a solution with a clear action plan. Our Solution, Your Success.